Navigating Medicare: a quick guide

Medicare is a federal health insurance program that provides healthcare to those who are 65 or older, as well as younger people with certain disabilities or other qualifying medical conditions and who receive Social Security.

Medicare 101

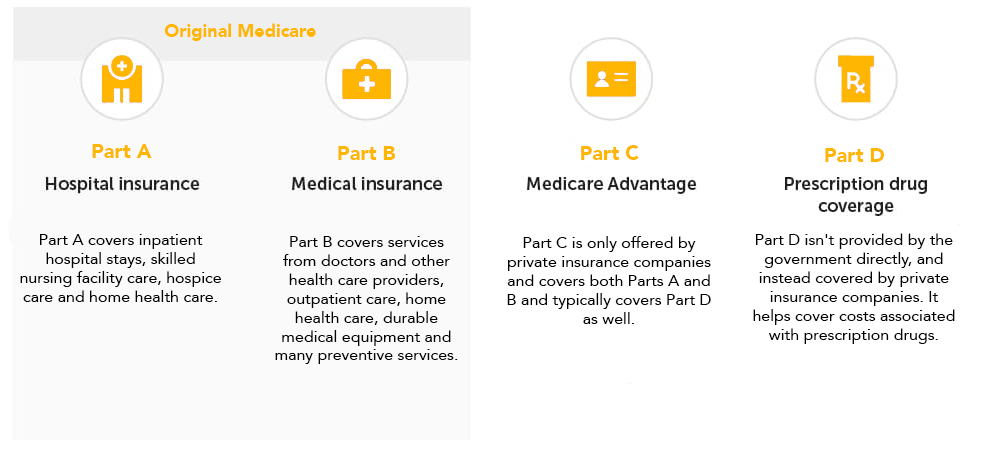

There are four parts of Medicare. Original Medicare is made up of two parts, Part A (hospital insurance) and Part B (medical insurance), and is offered by the federal government. Medicare Part C (also known as Medicare Advantage) is offered by private insurance companies such as WellSense to provide extra benefits that Original Medicare doesn't cover. Part D helps cover the costs of prescription drugs and is also offered by private insurance companies as either a stand-alone plan or as part of a Medicare Advantage plan.

Part A:

Hospital insurance

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care and home health care.

Part B:

Medical insurance

Part C:

Medicare Advantage

Part D:

Prescription drug coverage

Coverage and costs

Original Medicare (Parts A & B)

- To receive Part B coverage, you are required to pay a monthly premium.

- You'll typically pay higher copays and coinsurance or a higher deductible.

- What you pay out-of-pocket has no yearly limit.

- Certain services like routine exams, most dental care and eye exams are not typically covered.

- You're free to choose any doctor or hospital across the United States that accepts Medicare.

Medicare Advantage (Part C)

- You are required to pay your Part B monthly premium. Some plans have a $0 premium and some can assist with paying a portion of your Part B premium.

- Medicare Advantage plans generally have lower copays and coinsurance and/or a smaller or no deductible.

- Each plan has a cap on the total amount you have to pay out-of-pocket every year.

- In addition to what's covered under Original Medicare, some plans may offer additional benefits such as dental, vision and hearing services.

- For non-emergency care, you must choose a provider within the plan's network who can work together to coordinate your care.

Eligibility

Your Initial Enrollment Period for Original Medicare begins three months before you turn 65 and ends three months after you turn 65. This period lasts for seven months total.

In addition, you must be a U.S. citizen or legal resident for five consecutive years, eligible for Social Security or the Railroad Retirement Board, and have paid into Medicare through payroll taxes.

If you miss your Initial Enrollment Period or plan on retiring past age 65, there are other times you can enroll. To learn about other important enrollment periods, click here.

Enroll in Original Medicare (Parts A and B)

If you meet the eligibility requirements for Original Medicare, you can enroll using one of the following methods:

- Apply online through the Social Security Administration

- Visit your local Social Security office

- Call the Social Security office or the Railroad Retirement Board

It’s important to note that if you miss your Initial Enrollment Period, you may have to pay a late enrollment penalty unless you meet certain criteria.

Enroll in a Medicare Advantage plan

Request our free, no-obligation Medicare guide today

Medicare 101

Original Medicare is made up of two parts, Part A (hospital insurance) and Part B (medical insurance). Medicare Part C (also known as Medicare Advantage) is offered by private insurance companies such as WellSense to provide extra benefits that Original Medicare doesn't offer. A separate Medicare drug plan, known as Part D, can be joined to help supplement prescription costs.

Understanding the Medicare parts

Medicare is divided into four parts: A, B, C, and D, with each part providing partial coverage to help pay for healthcare expenses.

Original Medicare vs. Medicare Advantage

Original Medicare and Medicare Advantage, though both regulated by the federal government, are offered through different entities. Original Medicare is covered by the government and contains Parts A and B. Medicare Advantage (Part C) is offered by private insurance companies and covers both Parts A and B and typically covers Part D as well.

Costs

| Original Medicare | Medicare Advantage |

| After meeting your deductible, you typically pay a coinsurance of 20% of the Medicare-approved amount for services covered by Part B. | The out-of-pocket expenses for healthcare services can differ between plans, with some plans having lower or higher costs for specific services. |

| To receive Part B coverage, you are required to pay a monthly premium. Additionally, if you opt for Medicare drug coverage through Part D, you will also have a separate monthly premium for that. | You're responsible for the Part B monthly premium and possibly the plan's premium. Certain plans have a premium of $0 and can assist with paying all or a portion of your Part B premium. The majority of plans offer Medicare drug coverage (Part D). |

| What you pay out-of-pocket has no yearly limit, unless you supplement your Original Medicare with Medigap, the Medicare Supplement Insurance. | Each plan has a cap on the total amount you have to pay out-of-pocket every year for services covered by Medicare Part A and Part B. Once you hit your plan’s cap, you won’t have to pay anything for covered Part A and Part B services for the remainder of the year. |

| To help cover out-of-pocket costs such as coinsurance, you have the option to enroll in Medigap. Additionally, you can utilize coverage from a previous employer or union, or Medicaid. | You don't need Medigap. |

Doctors and hospitals

| Original Medicare | Medicare Advantage |

| You are free to choose any doctor or hospital across the United States that accepts Medicare. | For non-emergency care, typically, you can only utilize healthcare providers who are in the plan’s service area and network. |

| For most situations, a referral to a specialist isn't needed. | Some plans may require a referral to see a specialist. |

Coverage

| Original Medicare | Medicare Advantage |

| Original Medicare generally includes coverage for medically necessary services and supplies provided in hospitals, doctors' offices, and other healthcare facilities. However, certain services like routine exams, most dental care, and eye exams are not typically covered by Original Medicare. | Medicare plans are required to provide coverage for all the medically necessary services that are covered under Original Medicare. Additionally, some plans may offer additional benefits beyond what Original Medicare covers, such as dental, vision, and hearing services. |

| Drug coverage can be obtained through a separate Medicare drug plan known as Part D. | Most plans include the Medicare drug coverage known as Part D. |

| Original Medicare typically doesn't require prior approval for coverage of most services and supplies. | For many plans, prior approval is often required for coverage of certain services or supplies. |

Eligibility and enrollment

Original Medicare (Parts A and B)

Most individuals are eligible for an Original Medicare plan (Parts A and B) around their 65 birthday. Other eligibilities are being a U.S. citizen or legal resident for five consecutive years, being eligible for Social Security or the Railroad Retirement Board, and having paid into Medicare through payroll taxes.

Enroll in Original Medicare by applying online through the Social Security Administration, visiting a local Social Security office or calling the Social Security office or the Railroad Retirement Board.

Your Initial Enrollment Period begins three months before you turn 65 and ends three months after you turn 65. This period lasts for 7 months total.

If you miss your Initial Enrollment Period for Medicare Parts A and B, you may have to pay a late enrollment penalty when you do enroll.

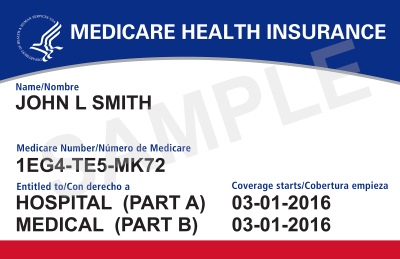

Your Medicare card

Once enrolled in Medicare, you will receive a Medicare card with a unique number. Remember to bring it with you to all medical appointments.

You are leaving the WellSense website

You are now leaving the WellSense website, and are being connected to a third party web site. Please note that WellSense is not responsible for the information, content or product(s) found on third party web sites.

By accessing the noted link you will be leaving our website and entering a website hosted by another party. Please be advised that you will no longer be subject to, or under the protection of, our privacy and security policies. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than ours.